The mortgage landscape is constantly evolving, and recent fluctuations in mortgage rates have created new opportunities for homebuyers. This comprehensive guide explores the implications of these changes and provides insights into the current trends impacting the housing market. As a result, potential buyers should be aware of how these changes affect their purchasing power and overall financial planning.

The Current Mortgage Landscape (08/29/2024)

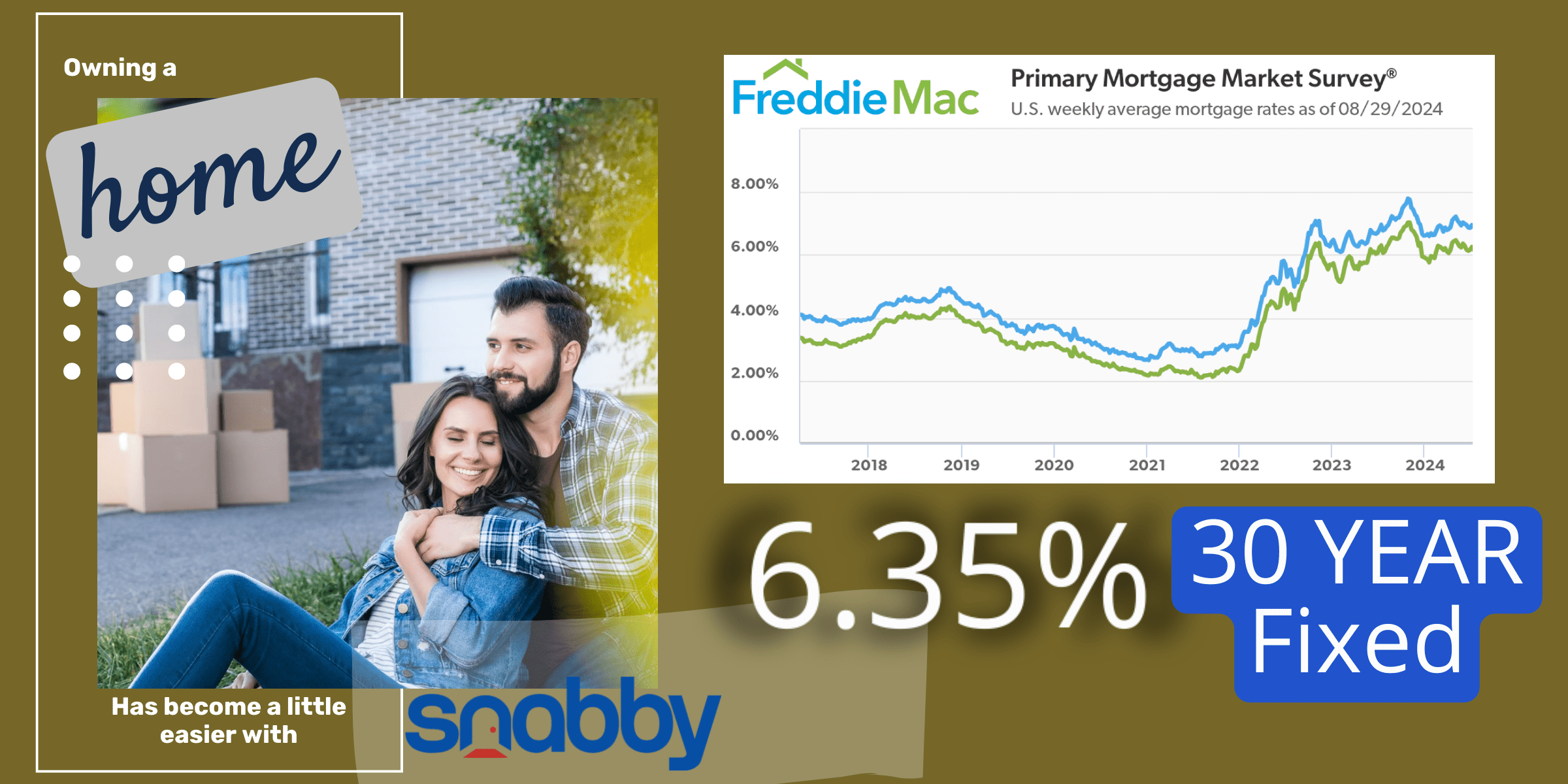

Mortgage rates have recently decreased to their lowest level in over a year, influenced by economic factors such as market turbulence and employment reports. This decline enhances the purchasing power of prospective homebuyers and opens up refinance opportunities for existing homeowners. According to Freddie Mac, the refinance share of market mortgage applications has surged, reaching nearly 42%, the highest since March 2022. This is a pivotal moment for both first-time buyers and seasoned homeowners to make their move in the real estate market.

Factors Influencing Mortgage Rates

- Economic Indicators: Employment reports and inflation rates are crucial in determining mortgage rate trends. When employment is strong and inflation is under control, mortgage rates typically stabilize or decrease. As these indicators fluctuate, so do the costs associated with home financing, creating a dynamic environment for buyers.

- Federal Reserve Policies: Decisions by the Federal Reserve, such as adjustments to interest rates, significantly impact mortgage rates. When the Fed lowers rates, it often leads to improvements in the overall affordability of home mortgages. Understanding these policy shifts can help buyers time their mortgage applications effectively.

- Market Conditions: Global economic conditions, including supply chain issues and labor shortages, can impact the housing market, driving changes in interest rates. It’s crucial for potential buyers to stay informed about these trends, as they directly affect available financial options.

Implications for Homebuyers

With lower mortgage rates, homebuyers may find themselves in a favorable position. The decrease in rates not only increases purchasing power but also encourages potential buyers to consider entering the housing market sooner rather than later. For existing homeowners, the current environment presents an ideal opportunity to refinance their mortgages, potentially reducing monthly payments and securing better terms. The influx of buyers can also mean more choices in the housing market, from new developments to existing homes, benefiting those looking to upgrade.

Benefits of Lower Mortgage Rates

- Increased Affordability: Lower rates mean lower monthly payments, making homeownership more accessible for first-time buyers and those looking to upgrade their living situation. This increased affordability allows families to allocate funds toward other essential expenses or savings.

- Refinancing Opportunities: Homeowners can refinance to secure better terms and reduce their financial burden, allowing them to save money and invest in other areas, such as home improvements or education. Exploring these refinance opportunities can be a strategic move to improve financial health.

- Market Entry: First-time buyers may find it easier to enter the real estate market with reduced rates, allowing them to snag homes while prices are still competitive. Programs aimed at assisting first-time buyers can capitalize on these current rates, offering additional incentives to buy.

Navigating the Mortgage Market

Understanding the nuances of mortgage rates and their impact on personal finances is crucial for anyone looking to buy or refinance a home. By staying informed and utilizing available resources, homebuyers can make well-informed decisions. Whether you are a first-time buyer or looking to refinance, it’s essential to consider all options and seek expert advice when necessary.

Unlock Your Dream Home Today! Discover exclusive mortgage rates and expert advice with Snabby.com. Don’t miss out— you can start your journey by using the Snabby Mortgage Calculators

Frequently Asked Questions

- What are the current mortgage rates?

- Mortgage rates fluctuate based on economic conditions, Federal Reserve policies, and market demand. It’s important to check with reliable sources or financial institutions for the most up-to-date rates.

- How can I take advantage of refinance opportunities?

- To take advantage of refinance opportunities, assess your current mortgage terms, compare them with current rates, and consult with a mortgage advisor to explore the best options for your financial situation.

- What factors should I consider when choosing a mortgage lender?

- When choosing a mortgage lender, consider factors such as interest rates, customer service, loan options, and the lender’s reputation. It’s also helpful to read reviews and seek recommendations from trusted sources.

[…] as they were feeling overwhelmed, the couple received some promising news—mortgage rates were beginning to decline. This shift was largely driven by expectations of a Federal Reserve rate cut, providing a […]